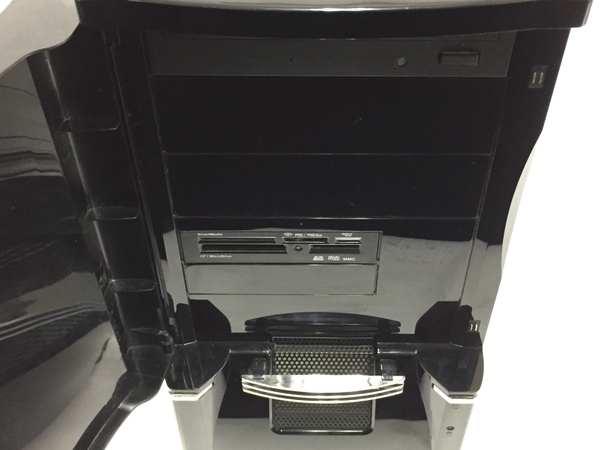

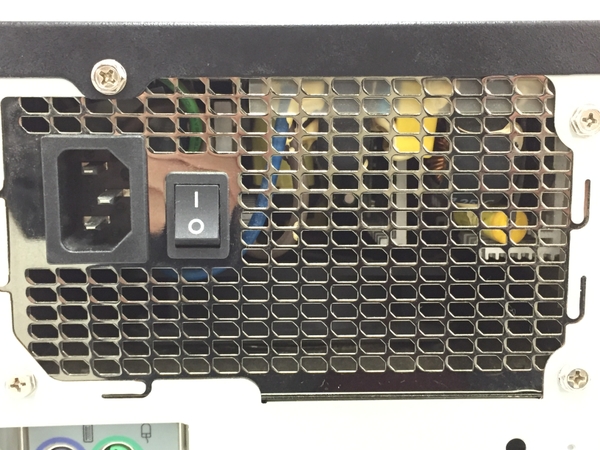

MouseComputer NG-i510BB3(デスクトップパソコン)

(税込) 送料込み

商品の説明

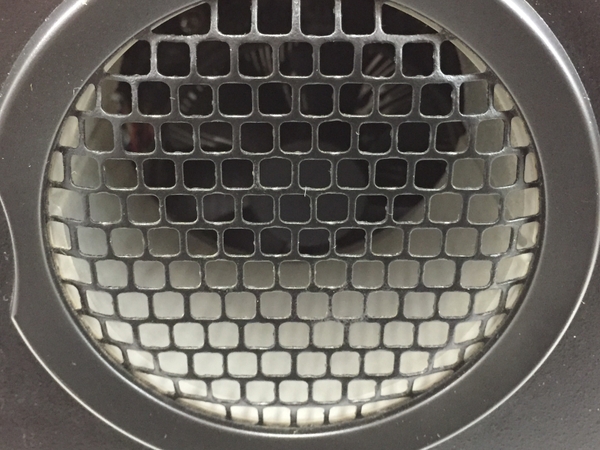

メーカー名MouseComputer型番 NG-i510BB3シリーズ G-TUNENEXTGEARシリアル U101461945付属品 電源ケーブルOS Windows 10 Home 64bitCPU Intel Core i7 860 2.80GHzメモリ 12GBストレージ HDD 2.0TBグラフィック NVIDIA GeForce GTX 760オフィスソフト 無カラー ブラック系動作 通電、DVD-R読み書き、USBポート、音声出力、正常マザーボード MSI P55-SD14518円MouseComputer NG-i510BB3(デスクトップパソコン)パソコンデスクトップパソコンマウスコンピューター デスクトップパソコン 買取 相場」の一覧mouse 【3年保証】 デスクトップ パソコン 省スペース スリム (Windows 11 Core i5 16GBメモリ 500GB SSD ビジネス テレワーク) LHI5U01B1SIW1AZ

デスクトップパソコン マウスコンピューター公式通販サイト

【ゲーミング】mouse デスクトップパソコン G-Tune(Core i5 10400/1650(GDDR6)/8GB/256GB/1TB/Win10) LG-C5081SHG5ZM【Windows 11 無料アップグレード対応】

mouse 【3年保証】 デスクトップ パソコン 省スペース スリム (Windows 11 Core i5 16GBメモリ 500GB SSD ビジネス テレワーク) LHI5U01B1SIW1AZ

ご家庭向け・一般用途向けのデスクトップパソコン mouse|マウス

ゲーミングPC デスクトップパソコン|G-Tune by マウスコンピューター

デスクトップパソコン mouse BIZD114M16 [モニター無し /intel Core i5 /メモリ:16GB /SSD:256GB /2021年11月モデル]

デスクトップパソコン マウスコンピューター公式通販サイト

マウスコンピューター デスクトップパソコン 買取 相場」の一覧

ゲーミングデスクトップパソコン G-Tune NMDI7G60BC61 [RTX 3060 /モニター無し /intel Core i7 /メモリ:16GB /SSD:1TB]

デスクトップパソコン マウスコンピューター公式通販サイト

デスクトップパソコン マウスコンピューター公式通販サイト

☆美品☆ゲーミングPC マウスコンピュータ 高性能機 デスクトップ

デスクトップパソコン マウスコンピューター公式通販サイト

mousecomputer NG-i540PA3 CPU:(Core i7-2600 3.4GHz /メモリ:8GB

Amazon | mouse 【3年保証】 デスクトップ パソコン 省スペース スリム

デスクトップパソコン mouse MPro-M600H [モニター無し /intel Core i5

mousecomputer NG-i540PA3 CPU:(Core i7-2600 3.40GHz /メモリ:16GB

ゲーミングデスクトップパソコン G-Tune NMDI7G60BC61 [RTX 3060 /モニター無し /intel Core i7 /メモリ:16GB /SSD:1TB]

Amazon | mouse 【3年保証】 デスクトップ パソコン 省スペース スリム

mousecomputer NG-i640GA10 CPU:Core i5-8400 2.8GHz/ メモリ:16GB

mousecomputer NG-i500GA3 CPU:(Core i7-860 2.80GHz/ メモリ:8GB

G-Tune EM-B [ Windows 11 ] GeForce RTX 3050 搭載│デスクトップ

Amazon | mouse 【3年保証】 デスクトップ パソコン 省スペース スリム

G-Tune EL-B [ Windows 11 ] GeForce RTX 3050 搭載│デスクトップ

Amazon | 【ゲーミング】mouse デスクトップパソコン G-Tune(Core i5

☆美品☆ゲーミングPC マウスコンピュータ 高性能機 デスクトップ

デスクトップパソコン マウスコンピューター公式通販サイト

mouse computer LM-i740K-EX | www.mumstheword.me

ゲーミングデスクトップパソコン G-Tune NMDI7G60BC61 [RTX 3060 /モニター無し /intel Core i7 /メモリ:16GB /SSD:1TB]

2023年最新】Yahoo!オークション -デスクトップパソコン(マウス

ゲーミングPC デスクトップパソコン|G-Tune by マウスコンピューター

Amazon | 【ゲーミング】mouse デスクトップパソコン G-Tune(Core i5

Yahoo!オークション -「win10 i5」(マウスコンピューター

デスクトップパソコン マウスコンピューター公式通販サイト

mouse 【3年保証】 デスクトップ パソコン 省スペース スリム (Windows 11 Core i5 16GBメモリ 500GB SSD ビジネス テレワーク) LHI5U01B1SIW1AZ

☆美品☆ゲーミングPC マウスコンピュータ 高性能機 デスクトップ

G-TUNE NG-im500BA8 デスクトップPC Core i5-2320 3GHz 4GB 動作確認

Yahoo!オークション -「win10 i5」(マウスコンピューター

Amazon | mouse 【3年保証】 デスクトップ パソコン 省スペース スリム

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![デスクトップパソコン mouse BIZD114M16 [モニター無し /intel Core i5 /メモリ:16GB /SSD:256GB /2021年11月モデル]](https://image.biccamera.com/img/00000009713310_A01.jpg)

![ゲーミングデスクトップパソコン G-Tune NMDI7G60BC61 [RTX 3060 /モニター無し /intel Core i7 /メモリ:16GB /SSD:1TB]](https://image.biccamera.com/img/00000011118170_A01.jpg)

![ゲーミングデスクトップパソコン G-Tune NMDI7G60BC61 [RTX 3060 /モニター無し /intel Core i7 /メモリ:16GB /SSD:1TB]](https://image.biccamera.com/img/00000011118170_A08.jpg)

![G-Tune EM-B [ Windows 11 ] GeForce RTX 3050 搭載│デスクトップ](https://www.mouse-jp.co.jp/img/item/gtune/G-Tune_EM/gallery05_g-tune_em_m.jpg)

![G-Tune EL-B [ Windows 11 ] GeForce RTX 3050 搭載│デスクトップ](https://www.mouse-jp.co.jp/img/item/gtune/G-Tune_PL/gallery05_g-tune_pl_m.jpg)

![ゲーミングデスクトップパソコン G-Tune NMDI7G60BC61 [RTX 3060 /モニター無し /intel Core i7 /メモリ:16GB /SSD:1TB]](https://image.biccamera.com/img/00000011118170_A02.jpg)