オリンパス E-3(デジタル一眼)

(税込) 送料込み

商品の説明

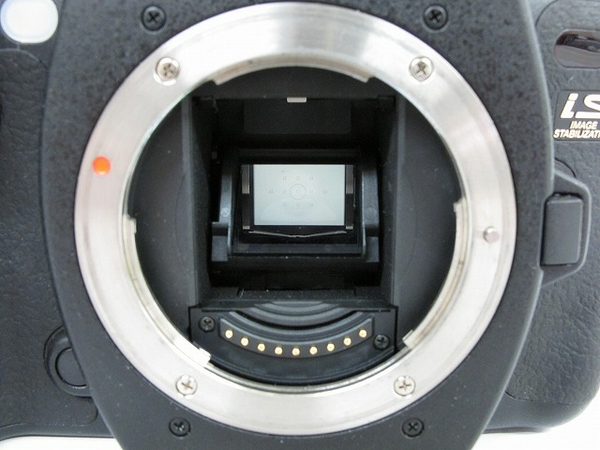

メーカー名OLYMPUS型番 E-3メーカー保証 無し対応マウント マイクロフォーサーズ付属品 画像にある物が全てですシリアル D68504830有効画素 1010万画素撮像素子 フォーサーズ4/3型 LiveMOS撮影感度 標準:ISO100~3200記録フォーマット JPEG/RAWサイズ 142.5 × 116.5 × 74.5 mm 重量:810g12010円オリンパス E-3(デジタル一眼)カメラデジタルカメラ楽天市場】オリンパス OLYMPUS デジタル一眼 E-3 【中古E-3:デジタル一眼レフ Eシリーズ:カメラ製品:オリンパス

OLYMPUS デジタル一眼レフカメラ E-3 ボディ E-3ボディ

オリンパス ニュースリリース: 世界最高速※AF搭載のデジタル一眼レフ

オリンパス OLYMPUS E-3 18-180mm 高倍率 レンズセット デジタル一眼

ASCII.jp:オリンパス、久々のフラッグシップデジタル一眼「E-3」を発表

Amazon.com: OLYMPUS E-3 マイスターブック (impress mook―DCM MOOK

コメ兵|OLYMPUS E-3|オリンパス|カメラ|デジタル一眼

中古 オリンパス E-3 ボディ (現状品) 程度:AB+ (良品プラス)

楽天市場】オリンパス OLYMPUS デジタル一眼 E-3 【中古

中古】(オリンパス) OLYMPUS E-3 ボデイ|ナニワグループオンライン

コメ兵|OLYMPUS E-3|オリンパス|カメラ|デジタル一眼

OLYMPUS - OLYMPUS デジタル一眼レフカメラ E-3 ボディ 本体のみの通販

Yahoo!オークション - ☆実用美品☆ OLYMPUS オリンパス E-3 ブラック...

オリンパス、Eシステム旗艦モデル「E-3」

オリンパスE 3を中古購入~2007年製デジタル一眼レフカメラ最上位機種

中古】 OLYMPUS ボディ&標準レンズ E-3 デジタル一眼レフカメラ

オリンパス OLYMPUS デジタル一眼レフカメラ E-3 ボディ E-3ボディ

コメ兵|OLYMPUS E-3|オリンパス|カメラ|デジタル一眼

オリンパス E-3 デジタル一眼レフカメラ | monsterdog.com.br

ヤフオク! - OLYMPUS オリンパス E-3 ブラックボディ デジタ...

Amazon | OLYMPUS デジタル一眼レフカメラ E-3 ボディ E-3ボディ

中古】(オリンパス) OLYMPUS E-3 ボデイ|ナニワグループオンライン

赤城耕一の「アカギカメラ」 第46回:気づけば干支が一回り。フォー

ヨドバシ.com - インプレス Impress OLYMPUS E-3マイスターブック

国内配送】 デジタル一眼レフカメラ OLYMPUS E-3 KIT SAISOKU E-3 最速

オリンパス OLYMPUS デジタル一眼レフカメラ E-3 ボディ E-3ボディ | フリマアプリ ラクマ

OLYMPUS/OM SYSTEM E-3 ボディ 中古 C2120140378338|フジヤカメラ

中古:B(並品)】オリンパス E-3 ボディ | 2444410005411

最高級 ☆良品☆ オリンパス ボディ E-3 OLYMPUS オリンパス

OLYMPUS E-3 【受注生産品】 11934円 www.coopetarrazu.com

OLYMPUS E-3 rb2eng.com.br

デジタル一眼レフ Eシリーズ:シリーズ別:オリンパス

OLYMPUS E-3は元フラッグシップのマッチョボディ!!デカくて重い

楽天市場】オリンパス OLYMPUS デジタル一眼 E-3 【中古

宅送] オリンパスE-3 - linsar.com

オリンパス E-3 ボディ 価格比較 - 価格.com

オリンパス E-3 ズイコーデジタル ED 18-180/3.5-6.3

レビュー](前編)待ち焦がれた相棒は、堂々たるフラッグシップモデル

Yahoo!オークション - 【並級】 OLYMPUS E-3 ボディ オリンパス デジ...

マップカメラ情報】オリンパス E-3 レポート 【後編】 | THE MAP TIMES

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![宅送] オリンパスE-3 - linsar.com](https://static.mercdn.net/item/detail/orig/photos/m27509752220_1.jpg)

待ち焦がれた相棒は、堂々たるフラッグシップモデル](https://japan.cnet.com/storage/2010/12/12/53c24358b46eb1f3cdd739339888c4c5/story_media/20374046/t/584/438/d/freeangle184x138_1.jpg)