Yupiteru Z996Csd(カーナビ)

(税込) 送料込み

商品の説明

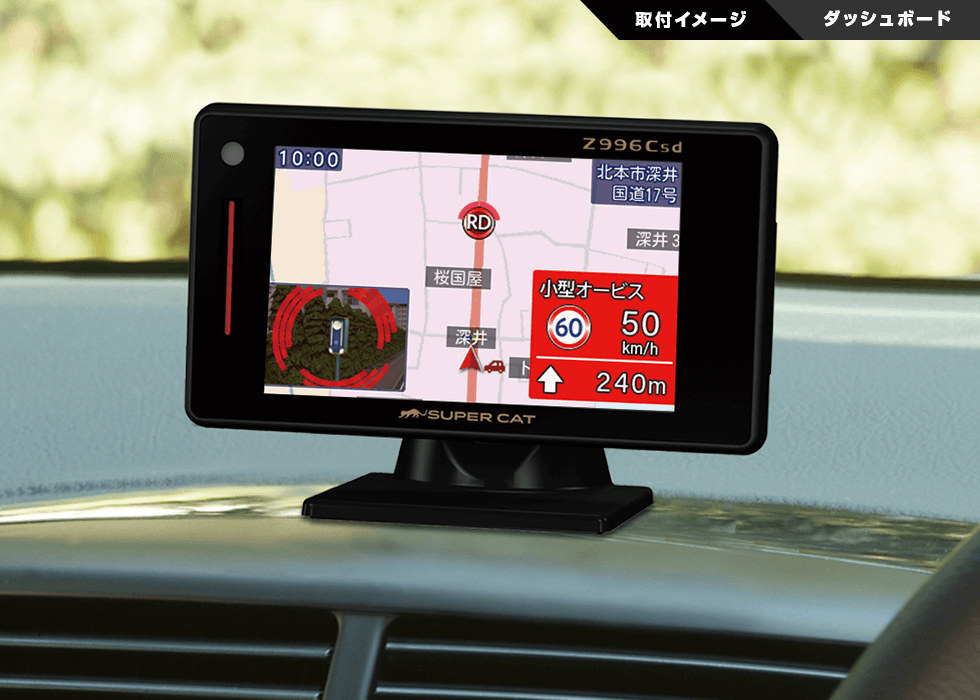

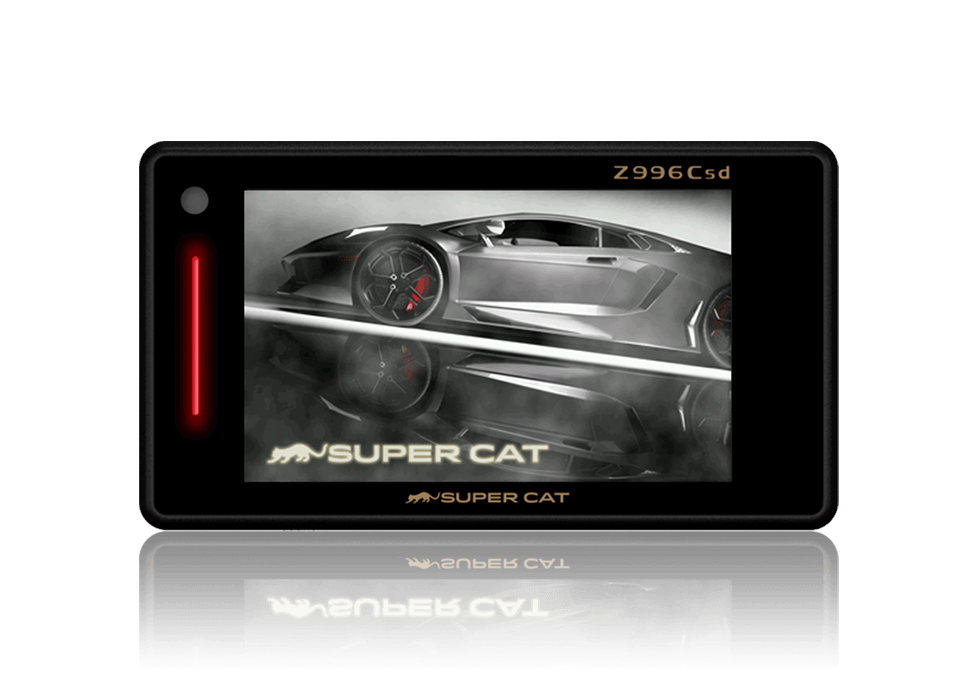

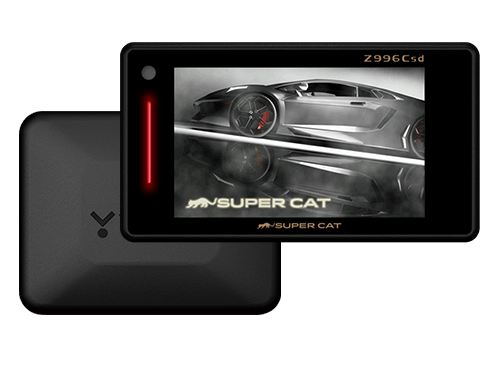

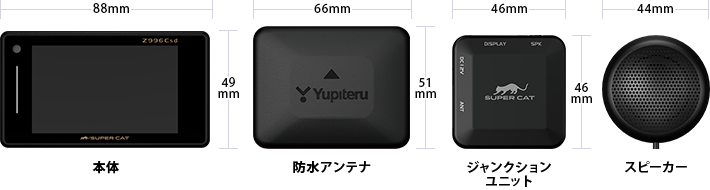

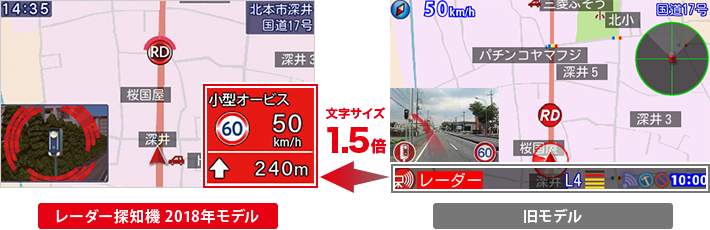

メーカー名Yupiteru型番 Z996Csdシリアル 80600112メーカー保証 なし23191円Yupiteru Z996Csd(カーナビ)カー用品カーナビZ996Csd|GPS&レーダー探知機|Yupiteru(ユピテル)Z996Csd|GPS&レーダー探知機|Yupiteru(ユピテル)

Z996Csd|GPS&レーダー探知機|Yupiteru(ユピテル)

Z996Csd|GPS&レーダー探知機|Yupiteru(ユピテル)

Z996Csd|GPS&レーダー探知機|Yupiteru(ユピテル)

Z996Csd|GPS&レーダー探知機|Yupiteru(ユピテル)

Z996Csd|GPS&レーダー探知機|Yupiteru(ユピテル)

Z996Csd 機能・仕様|GPS&レーダー探知機|Yupiteru(ユピテル)

Z996Csd|GPS&レーダー探知機|Yupiteru(ユピテル)

Z996Csd|GPS&レーダー探知機|Yupiteru(ユピテル)

Z996Csd 機能・仕様|GPS&レーダー探知機|Yupiteru(ユピテル)

Z996Csd 機能・仕様|GPS&レーダー探知機|Yupiteru(ユピテル)

Z996Csd 機能・仕様|GPS&レーダー探知機|Yupiteru(ユピテル)

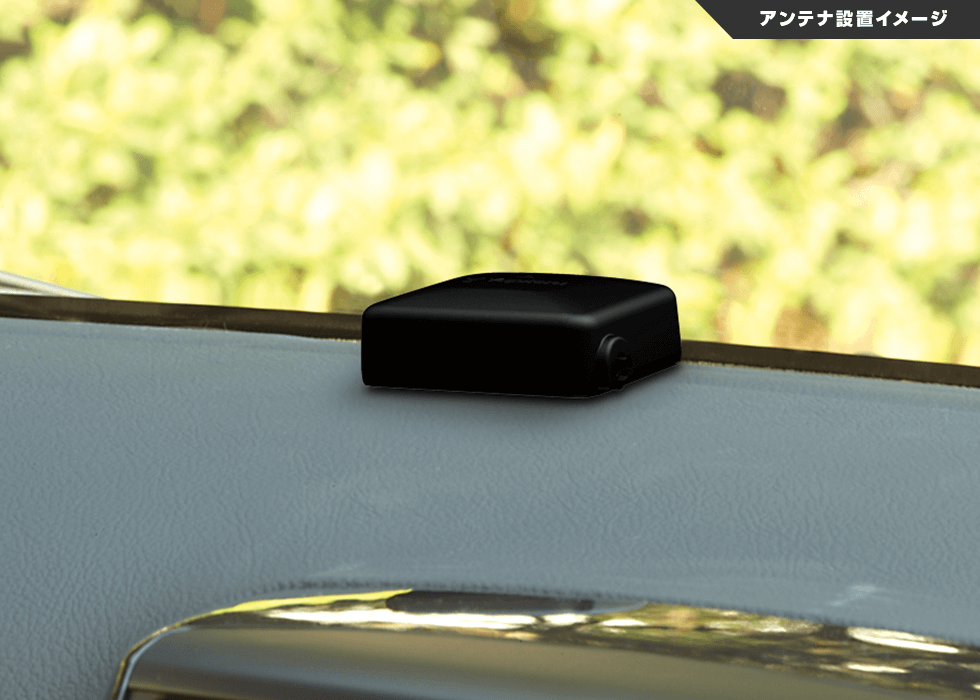

レーダ探知機】 新製品! ユピテル Z996Csd 4ピースセパレートタイプ

Z996Csd|GPS&レーダー探知機|Yupiteru(ユピテル)

Z996Csd|GPS&レーダー探知機|Yupiteru(ユピテル)

Z996Csd 機能・仕様|GPS&レーダー探知機|Yupiteru(ユピテル)

Z996Csd|GPS&レーダー探知機|Yupiteru(ユピテル)

Z996Csd 機能・仕様|GPS&レーダー探知機|Yupiteru(ユピテル)

Z996Csd|GPS&レーダー探知機|Yupiteru(ユピテル)

Z996Csd|GPS&レーダー探知機|Yupiteru(ユピテル)

トヨタ アルファードにユピテル Z996Csd GPS&レーダー探知機

[モバイクス] ユピテル レーダー探知機用 取付ステー [RD-YUPITERU1]+シガープラグコード [DC8]のセット品 ダッシュボード(曲面対応) 吊り下げも可能なブラケット(レーダー購入時 付属品のボールジョイントブラケットと DC電源 OP-12U / OP-7U /

Z995Csd|GPS&レーダー探知機|Yupiteru(ユピテル)

50系プリウス ユピテル指定店レーダーZ996csd TVキャンセラー

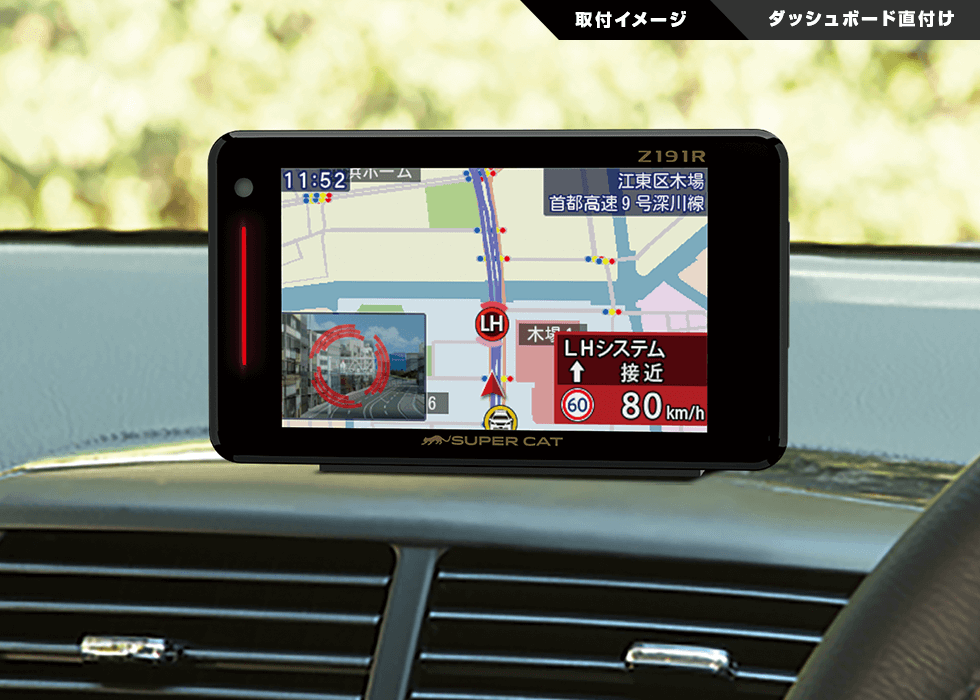

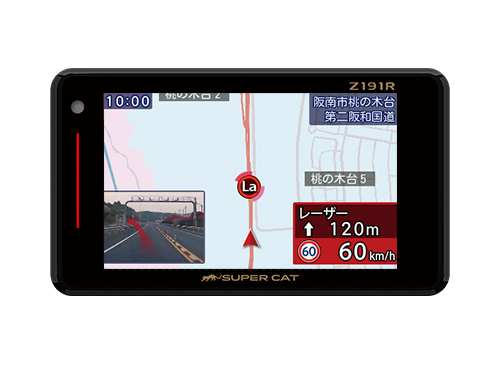

Z191R|GPS&レーダー探知機|Yupiteru(ユピテル)

50系プリウス ユピテル指定店レーダーZ996csd TVキャンセラー

○日本正規品○ データ最新 レーザー対応 箱付属品付 A370 yupiteru

YUPITERU ユピテル Z965Csd レーダー探知機 | mdh.com.sa

50系プリウス ユピテル指定店レーダーZ996csd TVキャンセラー

Z191R|GPS&レーダー探知機|Yupiteru(ユピテル)

Z995Csd|GPS&レーダー探知機|Yupiteru(ユピテル)

ユピテル スーパーキャットZ996Csd レーダー探知機一式 アダプター付き

Z996csd & LS10 最新人気 9000円 www.coopetarrazu.com

50系プリウス ユピテル指定店レーダーZ996csd TVキャンセラー

欲しいの Yupiteru レーダー探知機 GWM105sd+シガープラグコード

ユピテル z996csd レーダー探知機 - レーダー探知機

ユピテル ドライブレコーダー Z996Csd 取り付け作業を紹介

ユピテル z996csd レーダー探知機 - レーダー探知機

2023年最新】Yahoo!オークション -スーパーキャットレーダー(レーダー

Amazon | [モバイクス] ユピテル レーダー探知機用 取付ステー [RD

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![[モバイクス] ユピテル レーダー探知機用 取付ステー [RD-YUPITERU1]+シガープラグコード [DC8]のセット品 ダッシュボード(曲面対応) 吊り下げも可能なブラケット(レーダー購入時 付属品のボールジョイントブラケットと DC電源 OP-12U / OP-7U /](https://m.media-amazon.com/images/I/61YM1IyWlpL.jpg)

![Amazon | [モバイクス] ユピテル レーダー探知機用 取付ステー [RD](https://images-fe.ssl-images-amazon.com/images/I/51qY1cjZ2BL._AC_UL210_SR210,210_.jpg)