Ayre DV-7(オーディオ)

(税込) 送料込み

商品の説明

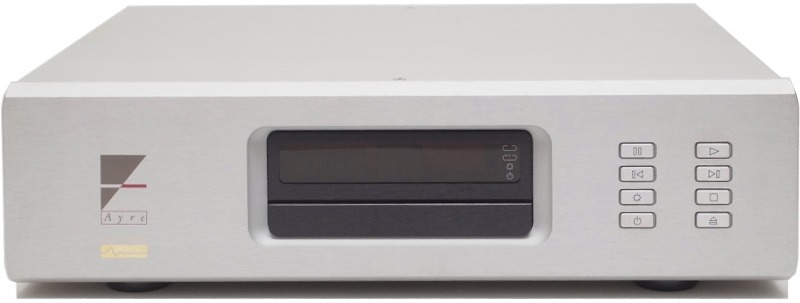

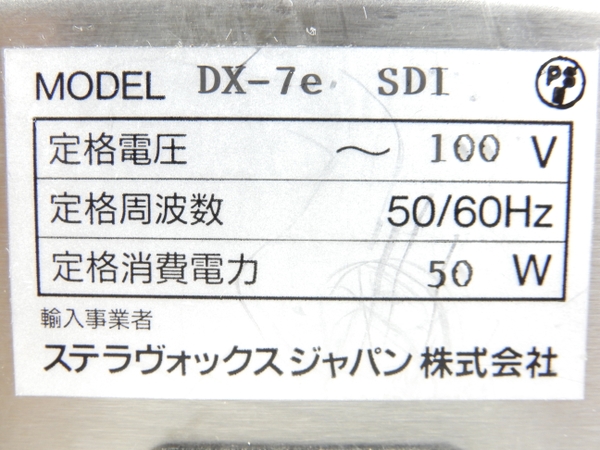

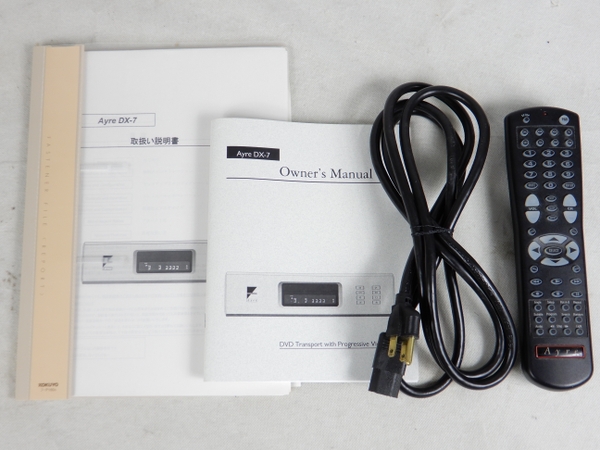

メーカー名Ayre型番 DV-7シリアル 画像参照40658円Ayre DV-7(オーディオ)オーディオAyre エアー DX-7 CD DVD トランスポーター プレイヤー 音響 オーディオAyre Acoustics CX-7e CD Player and AX-7e Integrated AmplifierAyre Acoustic DX-7 CD | DVD TRANSPORT > Balanced XLR | AES > MSRP

Ayre DX-7 DVD-V/CD player | Sound & Vision

Ayre Acoustic DX-7 CD | DVD TRANSPORT > Balanced XLR | AES > MSRP

Ayre Acoustic DX-7 CD | DVD TRANSPORT > Balanced XLR | AES > MSRP

Ayre Acoustic DX-7 CD | DVD TRANSPORT > Balanced XLR | AES > MSRP

Ayre Acoustic DX-7 CD | DVD TRANSPORT > Balanced XLR | AES > MSRP

Ayre DX-7 DVD-V/CD player Page 2 | Sound & Vision

Ayre Acoustic DX-7 CD | DVD TRANSPORT > Balanced XLR | AES > MSRP

Ayre Acoustics CX-7e CD Player and AX-7e Integrated Amplifier

Ayre Acoustic DX-7 CD | DVD TRANSPORT > Balanced XLR | AES > MSRP

Ayre AX-7 integrated amplifier | Stereophile.com

AYRE(エアー) CX-7eMP CDプレーヤー AX-7e プリメインアンプ 音質

Ayre CX-7 Evolution CD Player Demo via OHM Model i and Parasound HCA-2200

Ayre Acoustics : AX-7e (UG) - 中古 | オーディオユニオン

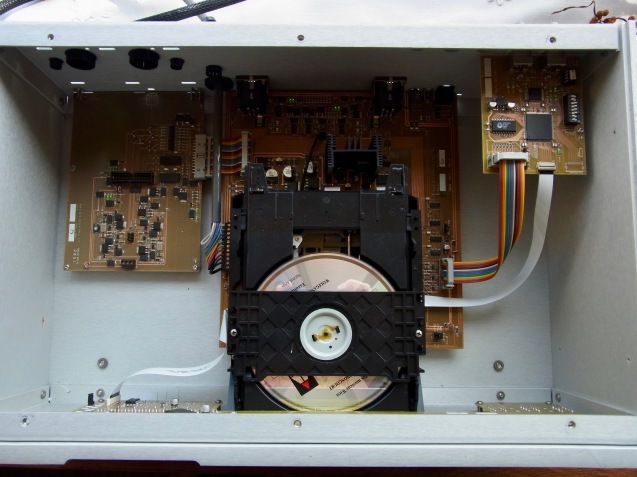

Ayre D1の上蓋を開けてスカスカの中身を覗く : Monologue at Park

AX-7 Ayre - 中古オーディオ 高価買取・販売 ハイファイ堂

AX-7 Ayre - 中古オーディオ 高価買取・販売 ハイファイ堂

Ayre Acoustic DX-7 CD | DVD TRANSPORT > Balanced XLR | AES > MSRP

Ayre Acoustic DX-7 CD | DVD TRANSPORT > Balanced XLR | AES > MSRP

デジタルプリアンプ・ヘッドフォンアンプ搭載D/Aコンバーター Ayre

Ayre CX-7 Evolution CD Player Demo via OHM Model i and Parasound

AX-7 Ayre - 中古オーディオ 高価買取・販売 ハイファイ堂

Ayre CX-7eMP CD Player; CX7 eMP; Silver; Remote

Arcam DV135 CD/SACD Player With Remote

WAudio 10 AWG Hi-End HiFi Audio Universal AC Power Cable Power Cord US Plug - 6.6FT (2M)

Arcam DV135 CD/SACD Player With Remote

Arcam DV135 CD/SACD Player With Remote

AYRE(エアー) CX-7eMP CDプレーヤー AX-7e プリメインアンプ 音質

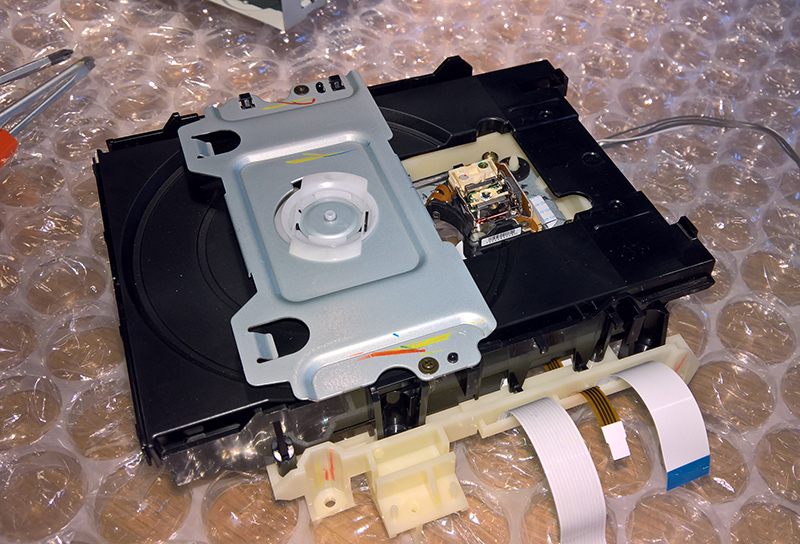

Replacing the Drive in an Ayre C-5xe MP | The Audio Standard

SoundStage! Equipment Review - Esoteric SA-60 Universal Audio

WAudio 10 AWG Hi-End HiFi Audio Universal AC Power Cable Power Cord US Plug - 6.6FT (2M)

Replacing the Drive in an Ayre C-5xe MP | The Audio Standard

Arcam DV135 CD/SACD Player With Remote

Stereophile | PDF | Phonograph | Sound Technology

SoundStage! Equipment Review - Esoteric D-07 Digital-to-Analog

Close to 800 digital sources from 1992 to 2023 ranked by THD

Listing test - - AV-Market.com

Sound System of the Week: DVD Man's Hybrid 2-Channel Rig & 7.2.2

Plinius Tautoro Preamplifier & SA-201 Stereo Power Amplifier

AYRE(エアー) CX-7eMP CDプレーヤー AX-7e プリメインアンプ 音質

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています