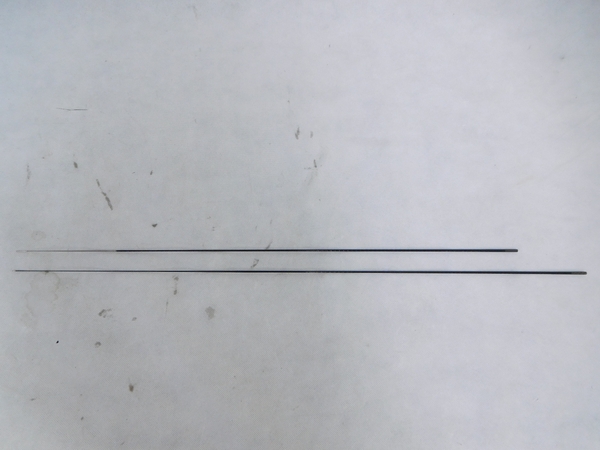

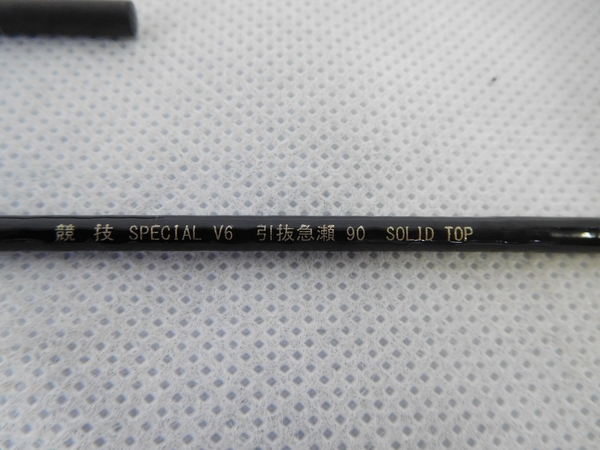

がまかつ 競技スペシャル V6 引抜急瀬 9m 竿

(税込) 送料込み

商品の説明

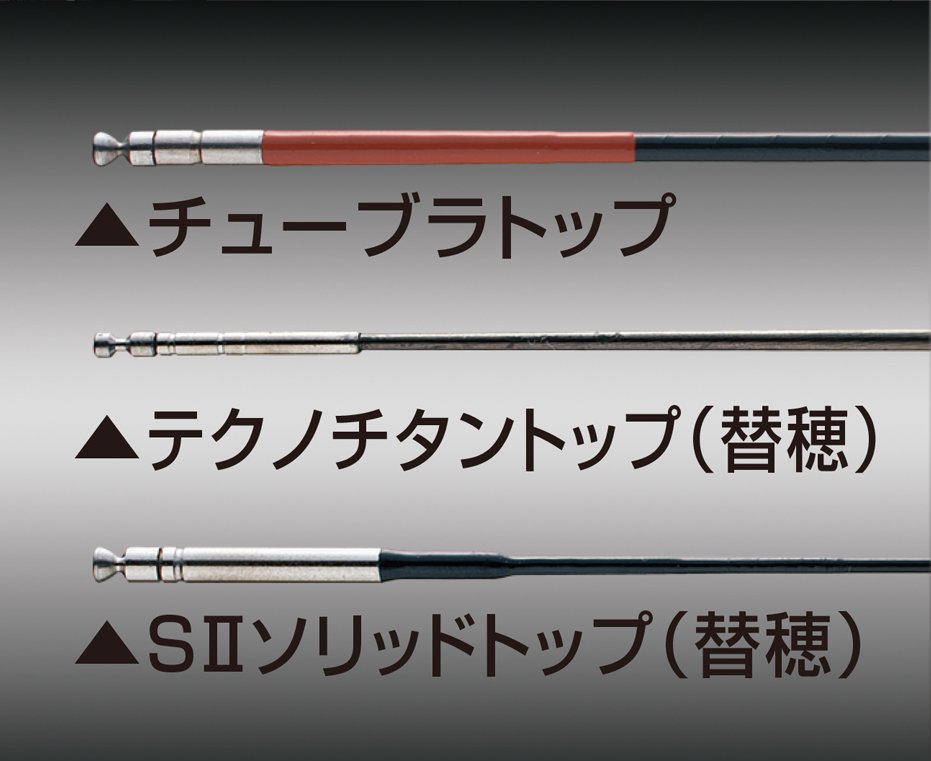

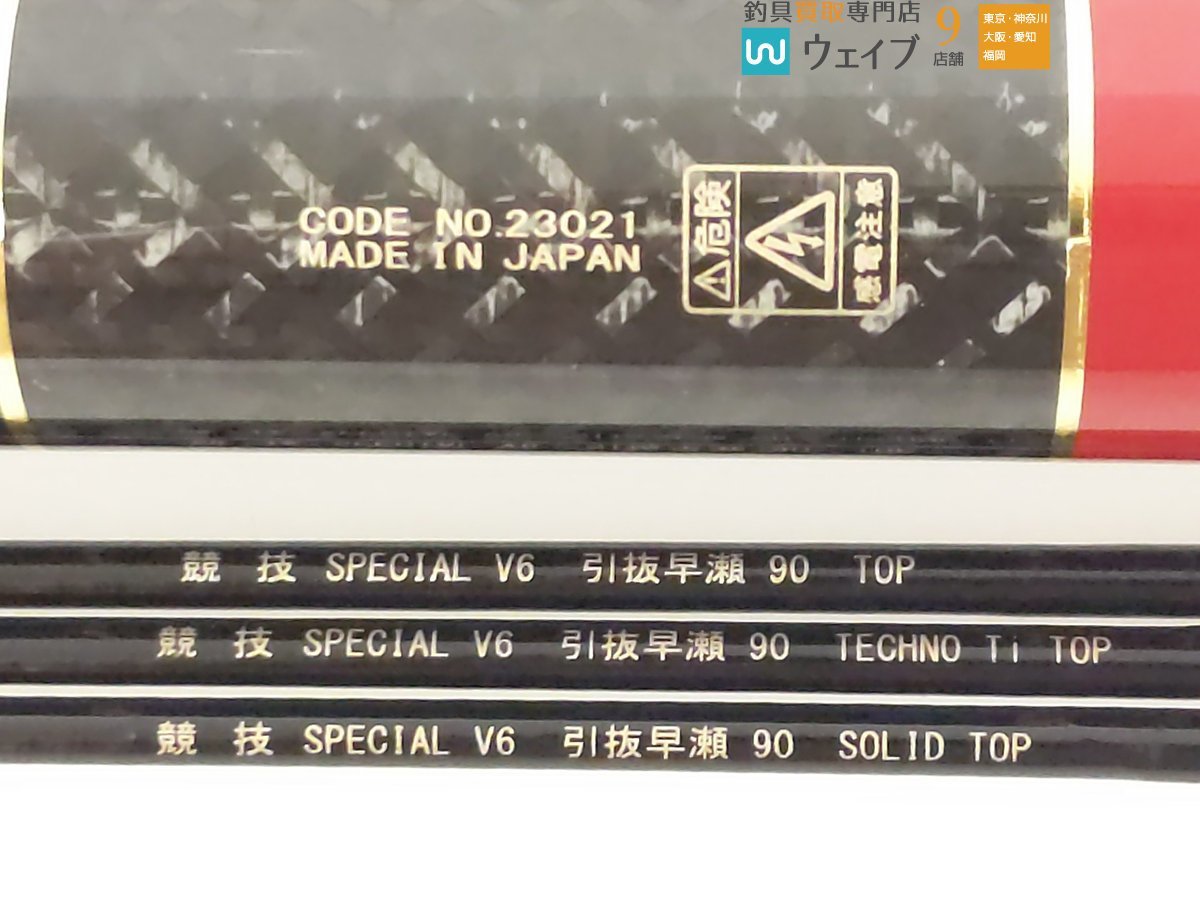

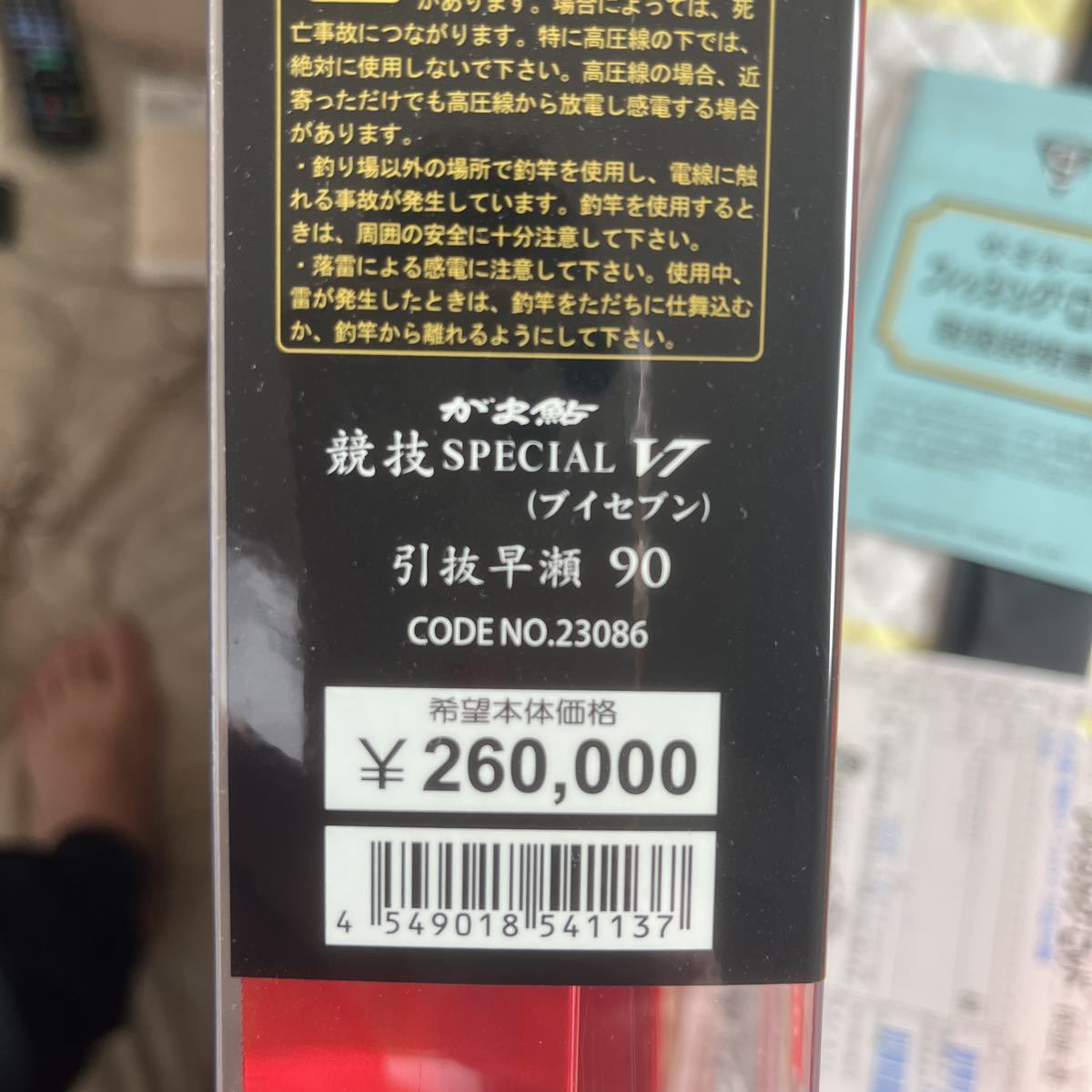

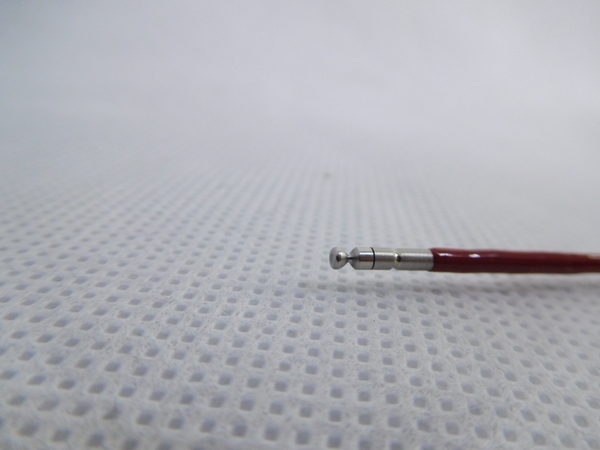

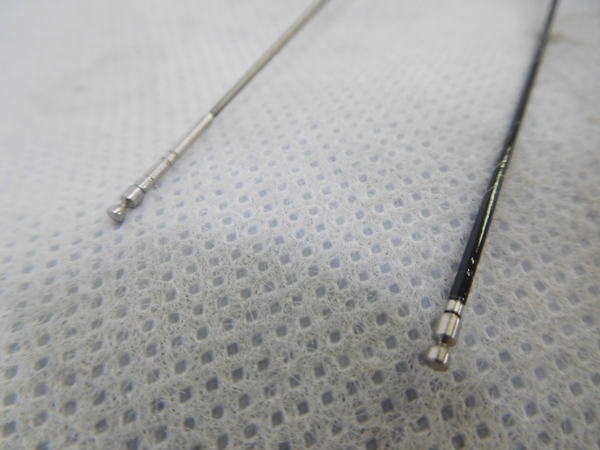

メーカー名ガマカツ長さ 9m付属品 画像参照先径 1.8mm元径 27.3mm替穂先径 0.7mmシリアル 1102184785555円がまかつ 競技スペシャル V6 引抜急瀬 9m 竿その他がまかつ 競技スペシャル V6 引抜急瀬 9m 竿鮎竿 がま鮎 競技スペシャルV6 急瀬 9m chateauduroi.coがまかつ 鮎竿 がま鮎 競技スペシャルV6 引抜急瀬 9m / 送料無料

がまかつ(Gamakatsu) がま鮎 競技スペシャルV6 引抜早瀬 9m 23021-9

がまかつ 鮎竿 がま鮎 競技スペシャルV6 引抜急瀬 9m / 送料無料

がまかつ 鮎竿 がま鮎 競技スペシャルV6 引抜急瀬 9m / 送料無料

がまかつ 鮎竿 がま鮎 競技スペシャルV6 引抜急瀬 9m / 送料無料

がまかつ 鮎竿 がま鮎 競技スペシャルV6 引抜急瀬 9m / 送料無料

がまかつ がま鮎競技スペシャルV6 引抜早瀬 9.0m-silversky

鮎竿 がまかつ競技 引抜早瀬 9m-

鮎竿 がま鮎 競技スペシャルV6 急瀬 9m chateauduroi.co

がまかつ がま鮎 競技 スペシャル V6 引抜早瀬 90 ※替え穂付

がまかつ 鮎竿 がま鮎 競技スペシャルV6 引抜早瀬 9m 中古 お洒落

ヤフオク! - がまかつ鮎竿 がま鮎競技スペシャルV6 引抜早瀬9m ジャ...

ガマカツ競技スペシャルv6硬中硬9.0-

がまかつ がま鮎 競技 スペシャル V6 引抜早瀬 90 ※替え穂付 | www.csi

新品☆がまかつ引抜急瀬9m元竿パーツ | monsterdog.com.br

がまかつ がま鮎 競技 スペシャル V6 引抜早瀬 90 ※替え穂付 | www.csi

がま鮎 競技スペシャル引抜急瀬90 smcint.com

がまかつ がま鮎 競技スペシャルⅡ 引抜早瀬9m-

がまかつ 鮎竿 がま鮎競技スペシャル2-

激安大特価! がまかつ がま鮎 競技 SPECIAL Ⅷ 引抜早瀬 90ロッド

がまかつ 鮎竿 がま鮎 競技スペシャルV6 引抜急瀬 9m / 送料無料

当店の記念日 鮎竿 がまかつ競技 引抜早瀬 9m ロッド | www.mkc.mk

管63837) 美品 がまかつ がま鮎 競技スペシャル V6 引抜急瀬 95 鮎竿

鮎竿 がまかつ競技 引抜早瀬 9m-

たけちゃん様専用 がまかつ鮎竿 競技Special引抜き急瀬90-

がま鮎竿競技V5 引抜早瀬 9m | monsterdog.com.br

品 がま鮎 競技スペシャル 引抜急瀬90 | hospitaldaprovidencia.org.br

がまかつ エクセルシオ ノブレス 引抜急瀬9m|鮎釣り、渓流釣り 鮎竿

当店の記念日 鮎竿 がまかつ競技 引抜早瀬 9m ロッド | www.mkc.mk

がまかつ鮎竿 競技スペシャルV-4-

品 がま鮎 競技スペシャル 引抜急瀬90 | hospitaldaprovidencia.org.br

シーズン前値下げ!がまかつ 競技スペシャルv5 引抜急瀬95-

がまかつ がま鮎 競技 スペシャル V6 引抜早瀬 90 ※替え穂付 | www.csi

がまかつ 鮎竿 がま鮎競技スペシャル2-

がまかつ鮎竿 がま鮎競技スペシャルV6 引抜早瀬9m ジャンク品(アユ竿

鮎竿 がまかつ競技 引抜早瀬 9m-

がま鮎 競技スペシャル V-Ⅳ 引抜早瀬90 ブイフォー がまかつ

がま鮎 競技 スペシャル V-IV 引抜急瀬 9m pn-jambi.go.id

たけちゃん様専用 がまかつ鮎竿 競技Special引抜き急瀬90-

がま鮎 競技SPECIAL. v7. 引抜早瀬 9m 美品 | transparencia.coronango

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています