U-CAN 測量士補 テキスト DVD 問題集 資格試験

(税込) 送料込み

商品の説明

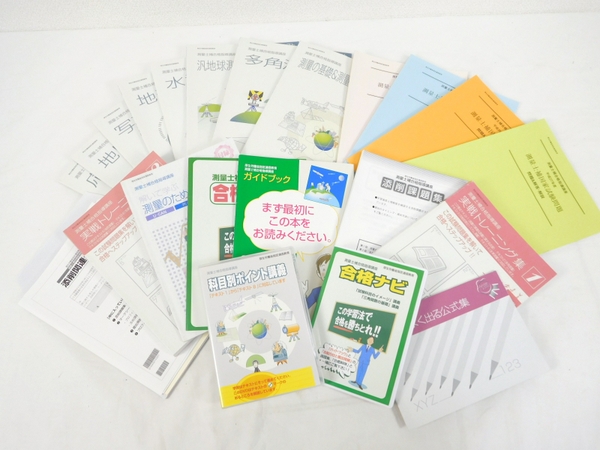

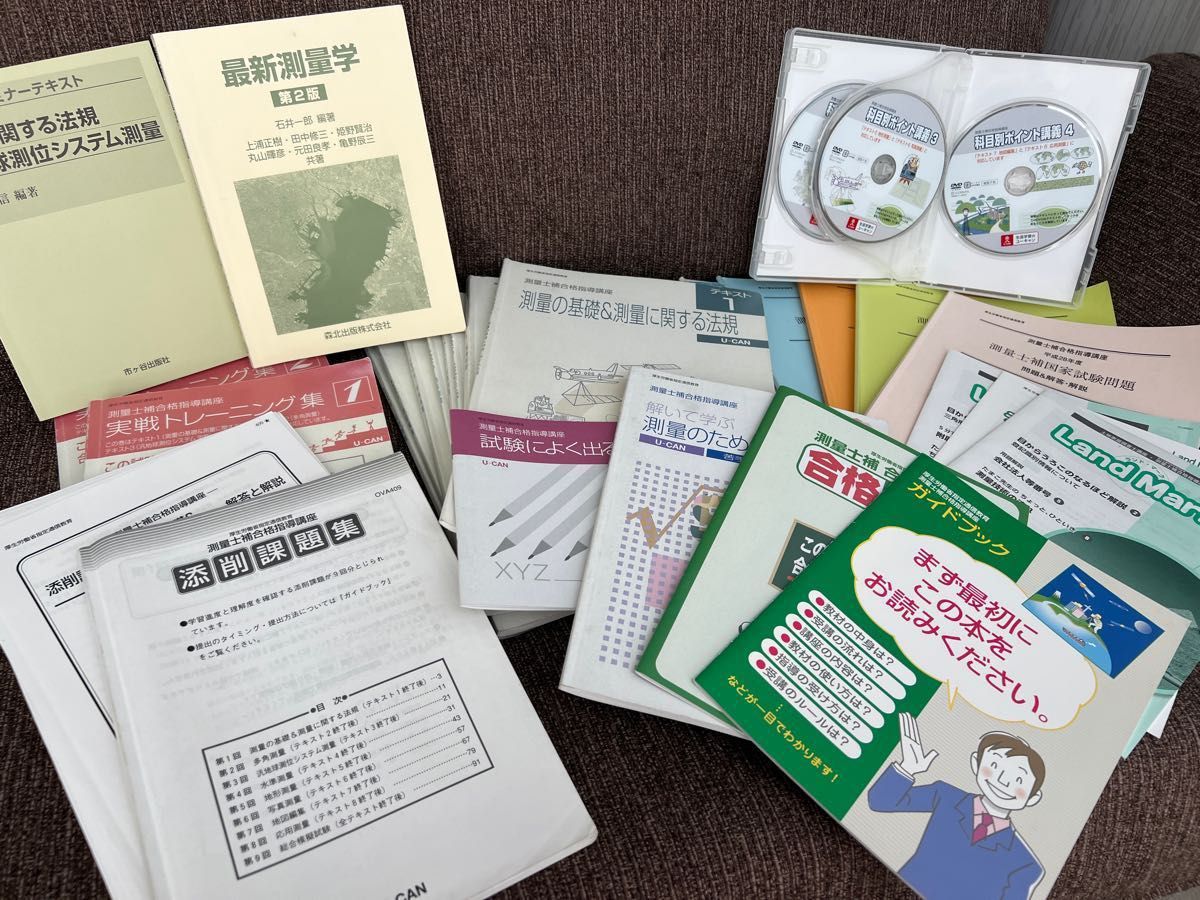

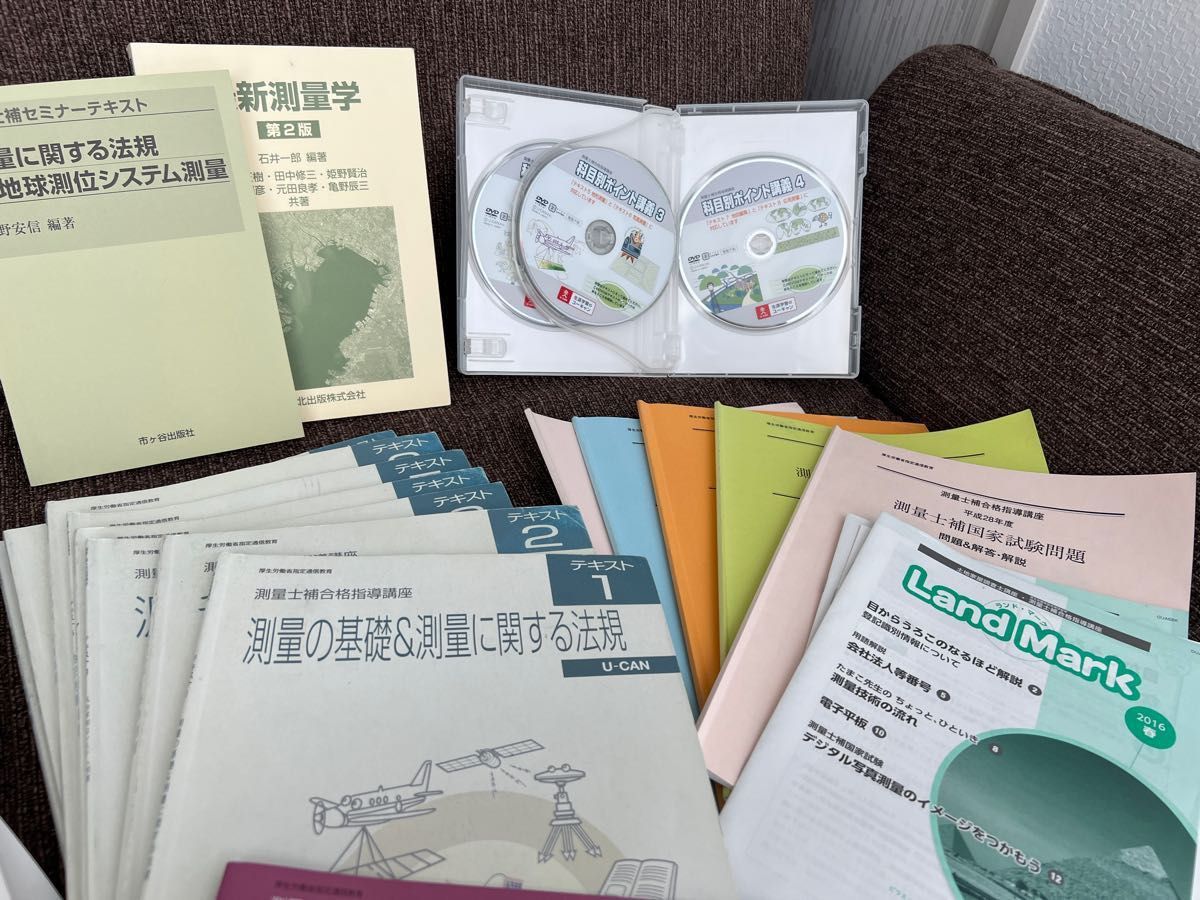

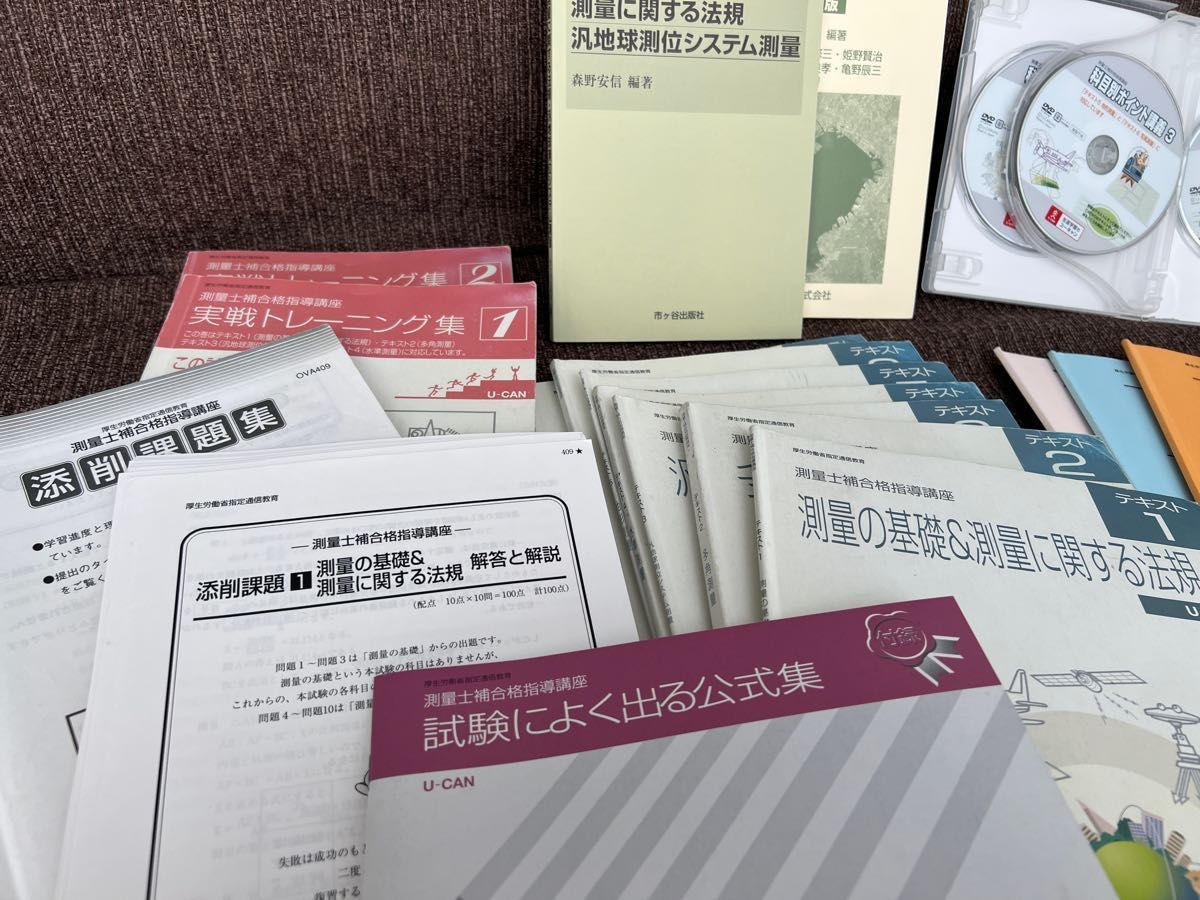

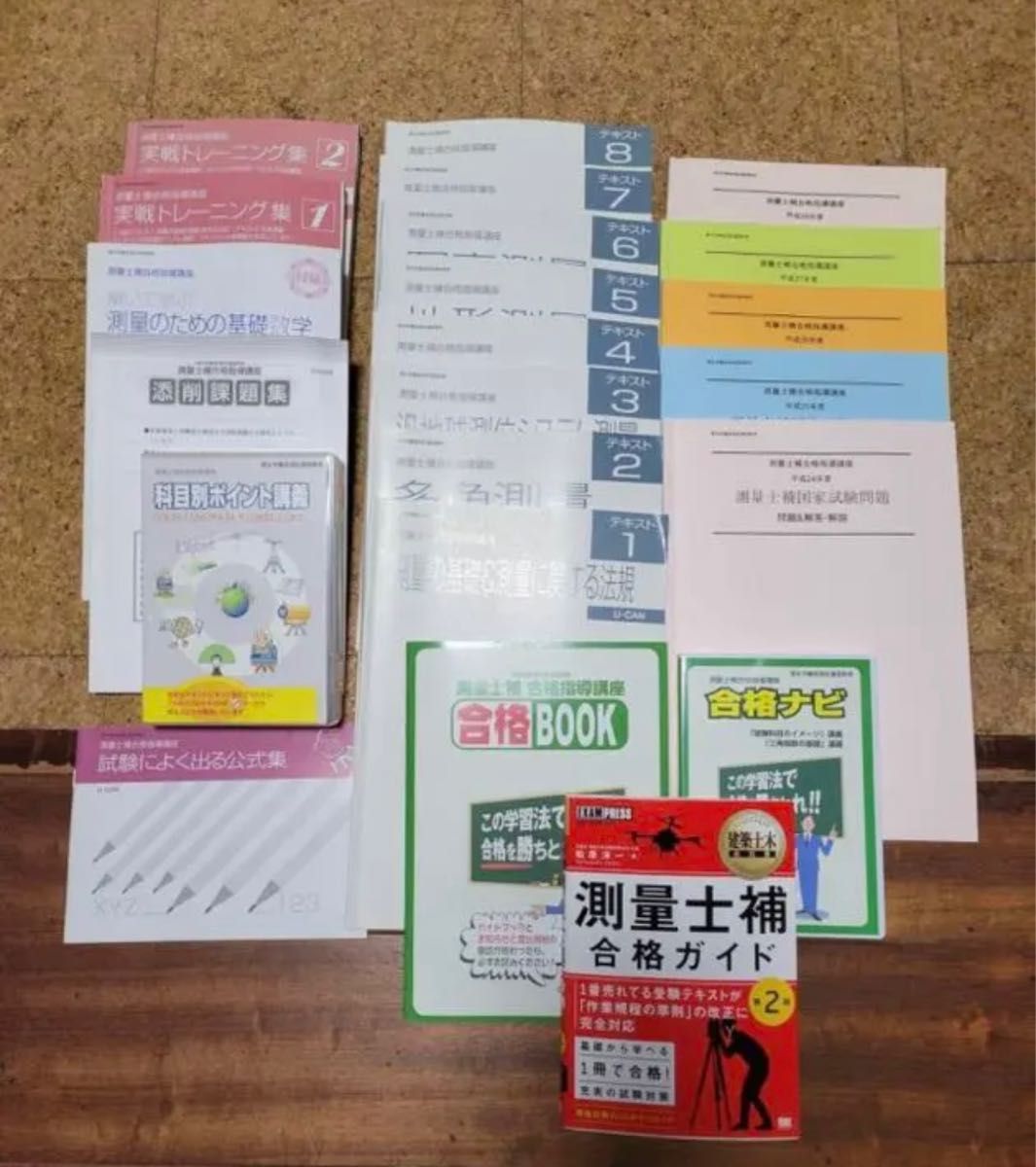

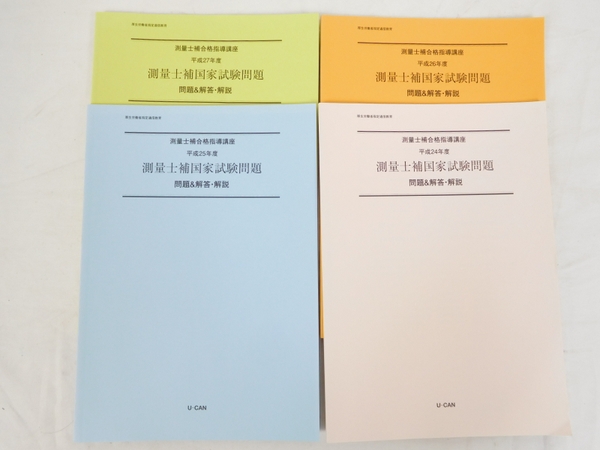

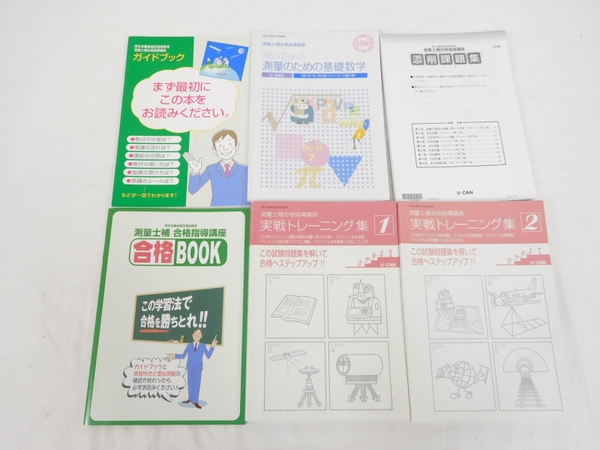

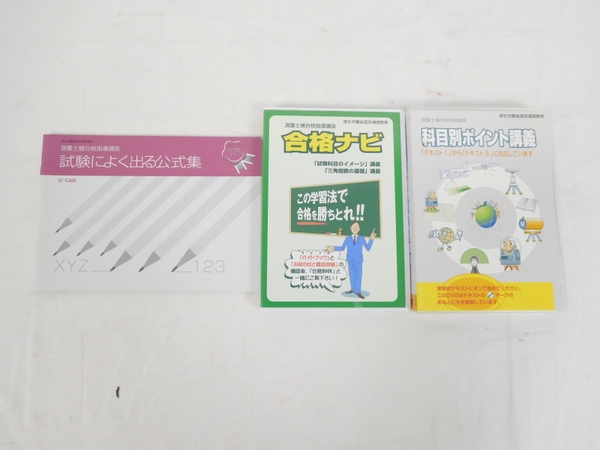

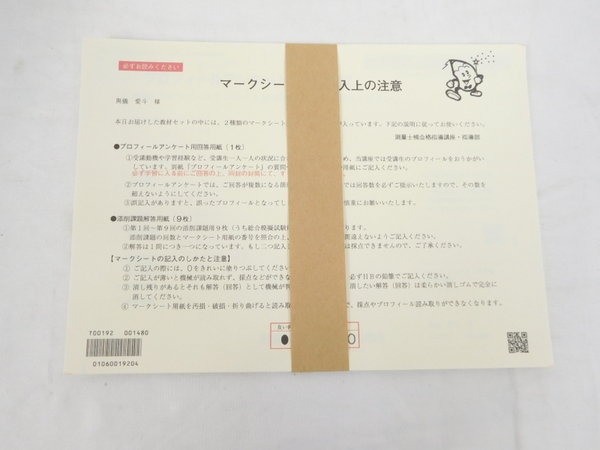

メーカー名U-CAN付属品 画像参照11122円U-CAN 測量士補 テキスト DVD 問題集 資格試験その他U-CAN 測量士補 テキスト DVD 問題集 資格試験ユーキャン 過去問 DVD 測量士補 テキスト&問題集&DVD 初学者ユーキャン 測量士補 U-CAN テキスト&DVD 国家資格-

ユーキャン(U-CAN) 測量士補試験合格指導講座 テキスト DVD 一式 - 参考書

ユーキャン 過去問 DVD 測量士補 テキスト&問題集&DVD 初学者

patepalo.com - 新しい到着 Y・Kさん専用 ユーキャン測量士補テキスト

ユーキャン 測量士補 U-CAN テキスト&DVD 国家資格 - 参考書

ユーキャン 測量士補 U-CAN テキスト&DVD 国家資格-

ユーキャン 過去問 DVD 測量士補 テキスト&問題集&DVD 初学者

ユーキャン 測量士補 U-CAN テキスト&DVD 国家資格-

ユーキャン 過去問 DVD 測量士補 テキスト&問題集&DVD 初学者

ユーキャン 測量士補テキスト&DVDセット 現品限り一斉値下げ! www

ユーキャン 測量士補テキスト\u0026DVDセット | ncrouchphotography.com

ユーキャン 測量士補 U-CAN テキスト&DVD 国家資格 - 参考書

ユーキャン 過去問 DVD 測量士補 テキスト&問題集&DVD 初学者

ユーキャン 測量士補 U-CAN テキスト&DVD 国家資格 - 参考書

ユーキャン 測量士補 U-CAN テキスト&DVD 国家資格 - 参考書

セール】 東京法経学院 測量士補 DVD12枚組 令和4年度模擬試験 合格

ユーキャン 過去問 DVD 測量士補 テキスト&問題集&DVD 初学者

美品!ユーキャン【測量士補テキスト&DVD全部セット】 国内外の人気が

測量士補 徹底図解テキスト&問題集 | 水野 雄 |本 | 通販 | Amazon

想像を超えての 【ジュードさま】土地活用プランナー (DVD、問題集

測量士補 ユーキャンの通販 16点 | フリマアプリ ラクマ

ユーキャン 測量士補 DVD確実合格講座セット オマケ付き|PayPayフリマ

改訂版 1冊合格!測量士補試験 | 書籍,書籍 |NOLTY 能率手帳・書籍

人気の贈り物が大集合 測量士補 答練 1〜4 東京法経学院 参考書

全ての ユーキャン 保育士試験 教材一式(令和4年版) 参考書 - lotnet.com

測量士試験・測量士補の試験参考書・問題集・テキスト古本買取

2023年最新】ユーキャン 測量士補の人気アイテム - メルカリ

測量士補 徹底図解テキスト&問題集 | ナツメ社

同梱不可】 【OHTANI】日本測量協会、測量士補国家試験、測量士受験

売り切り御免!】 未使用ユーキャン行政書士合格講座U-CAN問題集過去問

測量士補 徹底図解テキスト&問題集 | 水野 雄 |本 | 通販 | Amazon

返品送料無料】 医療事務講座 ユーキャン テキスト 参考書 - vsis.lk

2023年】測量士補のテキストのおすすめ人気ランキング28選 | mybest

人気を誇る 年最新ネイル資格におすすめの通信講座ランキング|人気社

2023年最新】測量士補は独学で合格できる?合格率や難易度も徹底調査

5%OFF】 測量士 2022】電卓 参考書一式【アガルート合格総合

最大の割引 公式!NSCA-CSCS資格認定試験 ガイドブック、問題集、DVD

測量士補 徹底図解テキスト&問題集 | ナツメ社

楽天市場】ユーキャンのマンション管理士・管理業務主任者はじめて

2023年】測量士補のテキストのおすすめ人気ランキング28選 | mybest

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています